37+ Mortgage calculator second time buyer

We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees. Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value.

10 Steps Toward Home Ownership Mortgage 1 Inc

With a capital and interest option you pay off the loan as well as the interest on it.

. The rate on the second mortgage will be higher than the rate on the first mortgage but on a blended basis it should not be much higher than the rate of a 90 LTV loan. Using The Mortgage Payment Table. This fee is rather easy to waive given how small it is relative to other expenses.

This might be the worst time you could buy. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. It is required on all mortgages with down payments of less than 20 which are known as high-ratio mortgages.

The first number format refers to the initial period of time that a hybrid mortgage is fixed whereas the second number refers to how frequently the rate can subsequently adjust after the fixed period. The balance of your mortgages at the time of issuing your Letter of Offer is used to determine eligibility. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Activate your credit card. For example you might want to calculate mortgage interest for a mortgage of 500000 with monthly payments of 2500 at a 3 mortgage rate. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find the.

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages. A home equity loan is often referred to as a second mortgage and is taken out in one lump sum. To calculate interest paid on a mortgage you will first need to know your mortgage balance the amount of your monthly mortgage payment and your mortgage interest rate.

Apply for a second credit card. 7YR Adjustable Rate Mortgage Calculator. See how your monthly payment changes by making updates to.

An 80-10-10 mortgage can. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. Private Mortgage Insurance PMI 0 to 1.

With our mortgage calculator its easy to find out how much you could borrow. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. A conventional mortgage on the other hand is one where the down payment is 20 or higher.

First time buyer mortgages. Buying a new home at the same time as youre selling your old home is all about timing and some luck of course. Storehouse Mortgage kept me informed every step of the way and even sent short videos explaining was was transpiring during each phase.

In this case you would be treated as a second time buyer meaning you would need to input 20 of the cost. Apply For A Mortgage Learn about the steps taken in applying for a mortgage. Some buyers get a second.

Already have a credit card with us. Input your data into our calculator to compare your estimated payments for a home equity loan vs. A HELOC is a line of credit you can draw funds from as needed similar to a credit card.

Then follow across to the payment factor for either a 15 or 30 year term. What Are Current Mortgage Rates. This was a unique surprise that made me feel comfortable and informed the entire time.

What you need to do what you need to have and what it costs. Mortgage default insurance commonly referred to as CMHC insurance protects the lender in the event the borrower defaults on the mortgage. Scan down the interest rate column to a given interest rate such as 7.

And while you cant control everything that happens during the complicated buying and selling process there are some things you can do to set yourself up for smooth closings maybe even on the same day. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. The most common ARM loans are 51 71 loans with the 31 101 being relatively less.

Learn more about mortgages made for first time buyers. Zillow has 21 photos of this 149900 4 beds 1 bath 1676 Square Feet single family home located at 37 Maple St Saunemin IL 61769 built in 1918. Learn more about mortgages made for first time buyers.

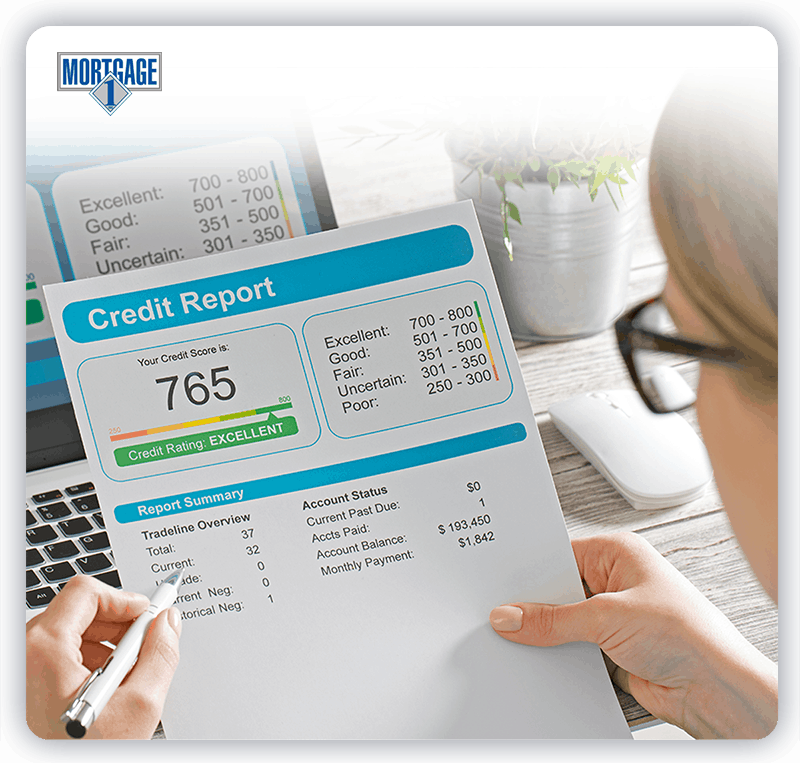

First Time Buyer Mortgage Guide As a first time buyer it can be difficult getting a deposit together and getting the right mortgage for your needs. Credit Report Loan Application. Multiply the factor shown by the number of thousands in your mortgage amount and the result is your monthly principal and interest payment.

Homeowners can pay an upfront sum to lock in a lower rate of interest if they know they will be living in a house for an extended period of time. The mortgage should be fully paid off by the end of the full mortgage term. I would highly recommend Storehouse Mortgage if you are in the market for a new home or refinancing your current home.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac. Bond Buyers 20 bond index.

The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. First Time Buyer Mortgage Guide As a first time buyer it can be difficult getting a deposit together and getting the right mortgage for your needs. With an interest only mortgage you are not actually paying off any of the loan.

At the end of the mortgage term the original loan will still need to be paid back. The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be. The rate on the 20-year fixed mortgage increased to 566 from 555 the week prior according to Freddie Mac.

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Tumblr Buying First Home Buying Your First Home Home Buying Process

7 Essential First Time Homebuyer Facts Mortgage Infographic Mortgage Infographic Home Buying Mortgage Marketing

Fixed Or Arm Mortgage Mortgage Infographic Mortgage Loan Originator

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

3

1

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

10 Steps Toward Home Ownership Mortgage 1 Inc

1

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Process

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www M Refinance Mortgage Refinancing Mortgage Refinance Loans

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

3

Kentucky Mortgage Loan Documents Needed For Approval Mortgage Loans Mortgage Loan Officer Refinance Mortgage

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans